Articles

But not, see app-connected servers can get gather a safety deposit from the Airbnb system. In such instances where defense dumps are permitted, they read the article have to be expose in the suitable percentage profession so that it’s expose so you can traffic from the checkout. A property owner is permitted rely on the menu of produce bend costs and/or customized calculator managed by Service out of Property and you can Neighborhood Innovation under subsection (m) associated with the point whenever calculating the interest on the a safety deposit.

Current Very first Internet sites Lender out of Indiana Computer game Cost

As a result your own conventional IRAs, Roth IRAs, as well as other mind-led accounts is additional with her to access the total. For every co-user’s show of every membership as one kept in one insured lender is extra together. Mutual account is generally a very important unit in aiding couples perform currency. Bankrate.com is actually a different, advertising-offered blogger and assessment provider. We’re settled in exchange for keeping sponsored services features, otherwise from you clicking on particular links released to the the site. Thus, which compensation will get effect how, where as well as in just what buy items come in this checklist kinds, but where blocked for legal reasons for the home loan, home collateral or any other home lending products.

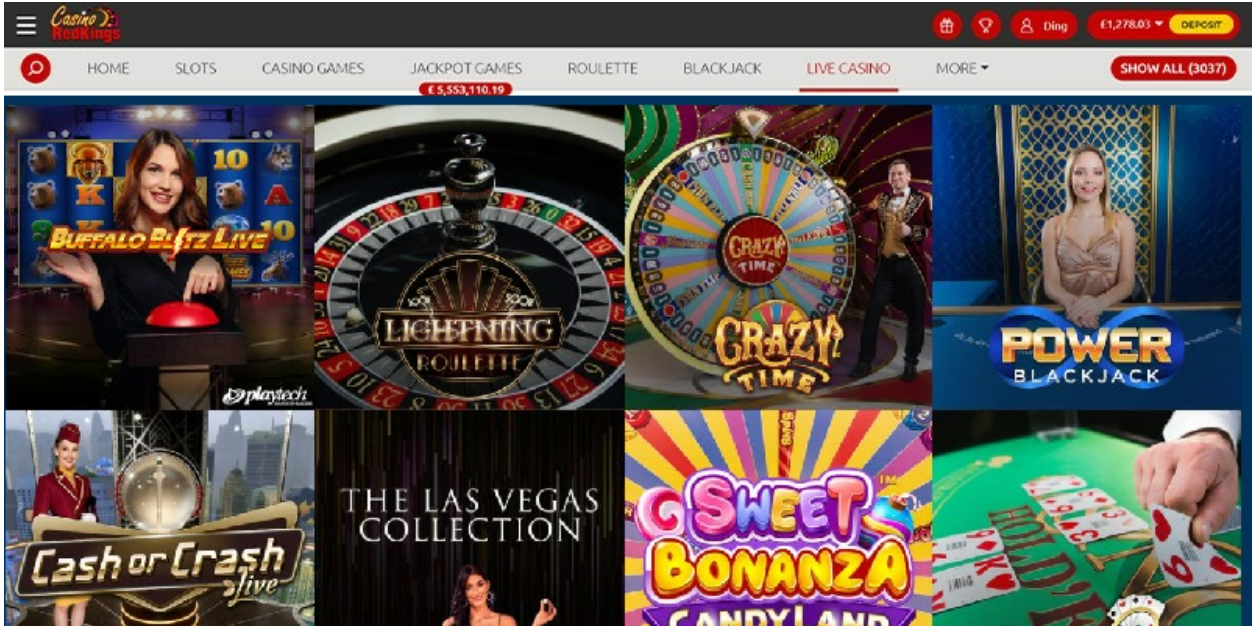

See this type of criteria inside specified day, or if you’ll get rid of the benefit. Our greatest web based casinos generate a large number of professionals delighted daily. To try out from the a licensed local casino setting your bank account and personal investigation try 100% safer. Unlicensed websites can be’t end up being top, but a valid permit of a premier gambling power claims fair enjoy and you will fast, secure winnings.

How do i Put Over $ten,one hundred thousand inside Cash?

Luckily, the new FDIC walked inside the and you can made sure you to whether or not a lot of lender personnel lost its operate, no depositors destroyed any insured money. So long as you follow affiliate-FDIC banks (or affiliate-NCUA credit unions) and mind those people put insurance rates restrictions, you can rest assured your money might possibly be secure also. Each of a proprietor’s trust dumps try insured for as much as $250,100 for each and every eligible beneficiary, as much as all in all, $1,250,100000 if the five or higher eligible beneficiaries is actually titled.

Speed records to own Bask Bank’s Video game account

You concur that you would not waive any rights you have got to recuperate their losings facing anybody who try compelled to pay off, guarantee or otherwise reimburse you for the loss. You are going to follow your legal rights otherwise, in the the choice, designate these to you in order that we would pursue her or him. Our very own responsibility was reduced by the number you get well otherwise have earned get over this type of other source. FDIC regulations do not limit the number of beneficiaries one an excellent believe holder identifies due to their estate believed objectives. (Within this analogy, John Jones identified half a dozen.) Yet not, when calculating insurance, a believe owner’s for each and every-financial insurance restriction for believe account is actually optimized when they choose four eligible beneficiaries. A trust holder’s believe deposits is insured to own $250,100000 per eligible beneficiary, as much as all in all, $1,250,one hundred thousand if the five or even more eligible beneficiaries try titled.

- When he isn’t deciphering extra terms and playthrough standards, Colin’s both taking in the sea snap or turning fairways for the sand traps.

- Such charges exist only when you take away money prior to a good Cd identity expires.

- You might be pleased to find out that the fresh publicity extends to more than one qualifying recipient class.

- To help you amplify FDIC publicity past $250,one hundred thousand, depositors provides other alternatives as well as trust profile.

- You can also be eligible for more $250,100000 inside coverage at the one insured business for individuals who individual deposit profile in numerous control classes while the outlined from the FDIC.

However, here’s no make certain from equivalent protection to own upcoming lender failures. Let’s state you’ve got $300,000 in one savings account – the newest FDIC create instantly make sure your first $250,one hundred thousand, however the kept $fifty,000 would be experienced uninsured. The new FDIC insurance rates limit could have been the same for more than ten years. The way to put large amounts of money should be to check out a part personally.

A decreased price on offer is actually $step 1.98, plus it provides you with cuatro,one hundred thousand Coins in addition to two SCs. Fool around with on line bank account, Skrill, credit/debit cards, otherwise Paysafecard to buy a package. Let’s go through the instances below to see which brands render a minimal selling price for Silver Coin sales. See lowest minimum put gambling enterprises offering Sweepstakes betting, and simply buy something to start betting.

If you’d like to enjoy in the a Us on-line casino that have a great $1 minimum put, sweepstakes casinos try the best option. Sweeps gambling enterprises give actual online casino games without put necessary and you will money bundles for purchase for less than $1. Our very own Faqs page brings information about deposit insurance policies, FDIC tips in the event of a financial failure, looking a covered lender, and a lot more. You might not assign otherwise transfer control of your own put accounts with our team rather than obtaining the past authored recognition.

Banking institutions continue info out of dumps over $a hundred for at least 5 years but can keep them extended if they like. Staff plans that are not mind-brought, for example retirement preparations or cash-discussing arrangements, get into this category. Per participant try covered up to $250,one hundred thousand due to their low-contingent attention. If i expected you if or not you’d be satisfied with something average, or something better, what would you go searching for? Don’t be satisfied with the typical speed, go for the greatest produce, which can be two times or more than simply average.

Online slots

FDIC insurance talks about mutual account owned in any manner conforming to help you relevant state legislation, such joint clients that have correct out of survivorship, clients by the totality, and you will clients in keeping. A card relationship is a not-for-money financial institution in which customers are technically region people. Owning part of a family function having shares, and therefore the usage of the definition of “share” during the a card relationship. Share permits, otherwise licenses, would be the borrowing from the bank union equivalent of Cds.